Blog Post

Supply Chain Pricing and Service Variabilities: Acquisitions and Upfit

By Barbara Banas & Sheryl Sawyers

October 28, 2021

As many of you are experiencing, the COVID-19 pandemic has affected many areas of the fleet supply chain and labor market. The entire industry is struggling through many pricing and service variability with vehicle manufactures, rental companies, transportation carriers, repair specialists and more.

Recently, we shared insights and provided recommendations on how to navigate challenges within our Maintenance and Collision National Accounts. Now, we’ll take a deeper look at what’s occurring within the vehicle acquisition supply chain.

Factory Ordering

Compared to Model Year 2021 to Model Year 2022, we have seen approximately an 8-10% decrease in vehicle incentives, with the domestic OEMs having a larger drop than the imports. This is anticipated to continue through the 4th quarter of 2021 and start to soften at the beginning of the 2022 calendar year. Furthermore, the OEM’s have been tightening their order dates and prioritizing by clients which has increased client demand for new vehicles even higher.

Out of Stock

With dealers experiencing limited inventory, they’re prioritizing their stock for consumer and retail sales over fleet sales to maximize their margin and allocation levels. Fleet management companies are finding it more difficult to secure vehicles. We also continue to experience higher fees and markups, with many dealers charging well over MSRP, not honoring fleet sales and fleet incentives, selling at retail only, and charging higher fees for transportation.

Rentals

Rental companies experienced a very challenging year. After COVID dramatically ceased travel in 2020, rental companies right sized their fleets, reorganized their teams and modified / closed stores, to adjust to the much lower demand for rental vehicles. However, in 2021, rental companies were unexpectedly hit with a high demand for rentals as many people opted to travel by vehicle than by airplane. Thus, rental companies were hit with significant demand that they struggled to fulfill this year.

Currently, our pricing has remained intact with no increases for our clients. However, if rentals are part of your acquisition strategy, we recommend making advanced reservations and / or providing advanced notice to secure vehicles. Many of our clients with seasonal vehicle needs have already secured vehicles.

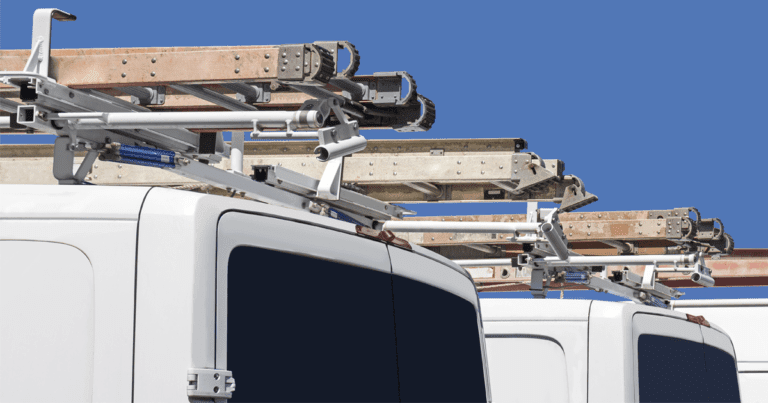

Upfit

Due to rising costs for metals, parts, and transportation, upfitters have had to adjust prices, ranging from 3-10%, or add surcharges to cover their costs. These surcharges will vary based on the type of upfit. Upfitters are also experiencing delays in lead times due to part shortages.

Plan, Order and Budget Accordingly

These challenges are expected to last until the end of 2021 and into 2022. To facilitate an easier acquisition and upfit process, it is important to note these four tips:

- Expect challenges: Supply chain uncertainty will continue into MY22.

- Plan it out: Refine your acquisition strategy for all vehicle needs. Don’t rely on just one strategy and consider extending lifecycles to make up for shortfalls.

- Order early: If you have not placed orders for MY 2022 vehicles yet, place them ASAP. The 2022 model year will be short and lead times will be long. This includes vehicles that require upfit.

- Budget accordingly: Adjust your fleet budgets to allow for these increases. Many factors that influence TCO (incentives, upfit, maintenance) are experiencing higher prices.

Wheels is here to help. We are ready to strategize and provide recommendations on how to respond to these unprecedented times. If you have any questions, please reach out to a member of your Wheels Account Team.