Operational Update

Registration

June is a block month for renewals in Illinois and Florida, which adds to our volume and makes this the 3rd largest month of the year. In these jurisdictions the states align all base commercial plate registration to one-time throughout the year. Florida is considered a hostage state, meaning all violations or flags against the vehicle need to be cleared before the renewal can be completed.

Illinois Campus:

- We completed 91% of the planned renewals before expiration. The largest opportunity for us here is completing the vehicle requirements in a timely manner to enable Wheels to complete the renewal before expiration.

- In June, 6% / 1,181 vehicles expired due to missing requirements.

Georgia Campus:

- We completed 94% of renewals prior to expiration.

- An additional 5% / 851 vehicles expired due to missing or late requirements. We continue to encourage drivers to notify the registration team via the mobile app when requirements have been completed to initiate the renewals process as soon as possible.

Acquisitions

Illinois Campus:

- Our Delivery Status team is focused on the oldest outliers (defined by vehicles at dealers > 30 days). In June, the total number of vehicles at the dealer at the end of the month and the number of dealers aging over 30 days stayed relatively flat, as new arrivals offset vehicles delivered.

- The Out-of-Stock team managed 1052 requests in June and averaged 3.9 days to locate vehicles for our clients. We are seeing cycle times around 20 days end-to-end process to secure a vehicle from a dealer.

Georgia Campus:

- Our Delivery Status team is focused on the oldest outliers (defined by vehicles at dealers > 30 days). In June, the number of vehicles at dealerships increased by 5%, while the number of vehicles aging over 30 days at the dealer increased by only 2%. The team is actively working to resolve the most aging deliveries.

- The Out-of-Stock team managed 954 requests in June and averaged 4 days to locate vehicles for our clients. We continue to see cycle times around 9 days end-to-end process to secure a vehicle from a dealer.

- Dealer inventory continues to improve year-over-year. We are seeing more aggressive retail pricing / incentives. The Hybrid vehicles are more challenging to acquire and cargo vans continue to be scarce.

Maintenance

Illinois Campus: In June, the Maintenance Contact Center improved the average speed of answer by 245 seconds. We expect continued improvement and are nearing target average answer speed. Many actions were taken throughout the month to assist vendors with the transition to MAP 2.0 and proactive measures are being taken to ensure target answer speeds are sustained.

Georgia Campus: Similarly, the Maintenance Contact Center improved the average speed of answer by 226 seconds. We expect the improvement to continue and are nearing target answer speeds.

Remarketing

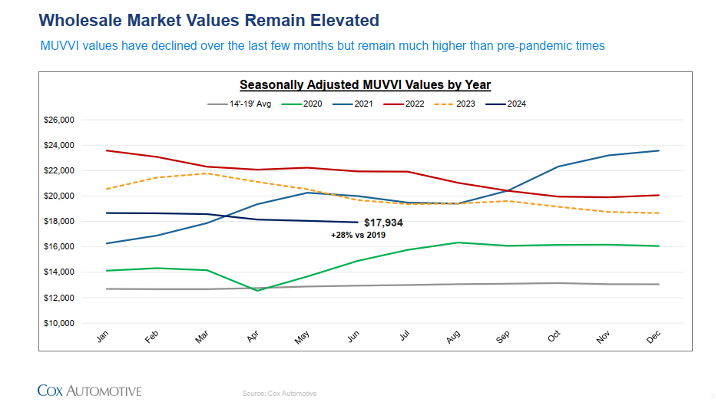

- June finished above May’s 99.4% of market at 100.9%. We are above 2023 results by 1.9% and up .3% YTD. Overall YTD we are comparable to last year’s market trends and wholesale seasonality is steadily returning to pre-pandemic markets trends. The wholesale market values remain elevated. June ended with a seasonally adjusted value at $17,934, up 28% from 2019.

- June days to sell at auction was 28.2 days down from May at 29.4, comparable to 2023 at 28.3.

Driver Contact Center

Illinois Campus: In June, the Illinois Driver Contact Center improved the average speed of answer by 100 seconds. We continue to see longer than normal wait times on Mondays (especially the first Monday of the month) and are working to improve on these days via overtime and adding new team members to the organization. We are dedicated to improving accessibility and continue to deliver on our commitment of First Contact Resolution by achieving a 97% FCR for June.

Georgia Campus: In June, the Alpharetta Driver Contact Center reported a 33 second average speed of answer with 83% of driver calls being answered in 30 seconds or less. Improving accessibility and resolution remains a priority for Driver Care. Additionally, First Contact Resolution achieved 81.0%, with 96.0% of all driver requests owned by the department being resolved / communicated within 24 hours.

Request Management / Responsiveness

- 84% (target is 85%) on 60,284 requests for Estimated Completion Date for requests.

- 6.5 days was the average cycle time to close a request case.

- 66% of the requests continue to be resolved within 2 business days.

- 75% were resolved within 4 business days.

- 5% of requests are taking >30 days to close due to transactions with longer processing lead times.

- The highest trends in June were Compliance based, where jurisdictional dependencies create longer completion cycles (state transfers, duplicates, amendments, etc.).